China's Export Ban: A New Front in the US-China Tech War

Advertisements

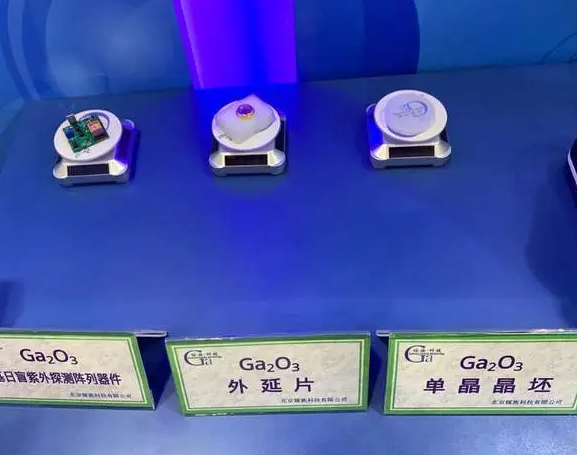

In recent times, China has taken a significant step by implementing export controls on critical dual-use items. This list notably includes gallium, germanium, antimony, superhard materials, and graphite. Such measures are clearly aimed at the United States and serve as a direct response to the restrictions imposed by the U.S. on China's semiconductor industry. The implications of this move have sparked a whirlwind of discussion and analysis, as stakeholders consider both immediate and far-reaching consequences.

Public reaction to these export controls is robust and varied. Some experts argue that this action will effectively send a strong message to the U.S., compelling it to reassess its trade policies with China. Conversely, others caution that while this move might impact the U.S. economy, it is unlikely to sever its supply chains entirely. The complexity of global trade networks and resource dependencies suggests a nuanced and multifaceted response from U.S. industries.

The supply landscape for antimony and graphite bears resemblance to that of gallium and germanium. China clearly leads in antimony production and smelting, but it is essential to recognize that there are also significant antimony resources available in overseas markets. In regard to graphite, China's output constitutes around 77% of global production, leaving 23% sourced from other regions as potential procurement avenues for the U.S.

Tracing the provenance of mineral resources poses greater challenges compared to electronic products like chips. Minerals lack clear branding or production markers, complicating efforts to track their movement along supply chains. This reality suggests that even if China enforces specific export controls against certain countries, other nations might find loopholes to indirectly facilitate the sale of such resources to the U.S. through re-exportation and similar trade practices.

This substantial reconfiguration of industrial frameworks will generate ripple effects throughout the U.S. industrial landscape, potentially eroding the country's competitive edge and market share in high-tech sectors. The ramifications for America's standing in the global economic landscape could be profound and far-reaching. This issue underscores the strategic intent behind China's export control measures, which aim not merely at short-term trade retaliation but also at fundamentally reshaping the trade balance and competitive dynamics between the U.S. and China in the high-tech domain. The ultimate goal is to secure a more advantageous strategic position for China within the global framework of technology and trade competition.

Leave a Reply