Global Supply and Export Competition Intensifies

Advertisements

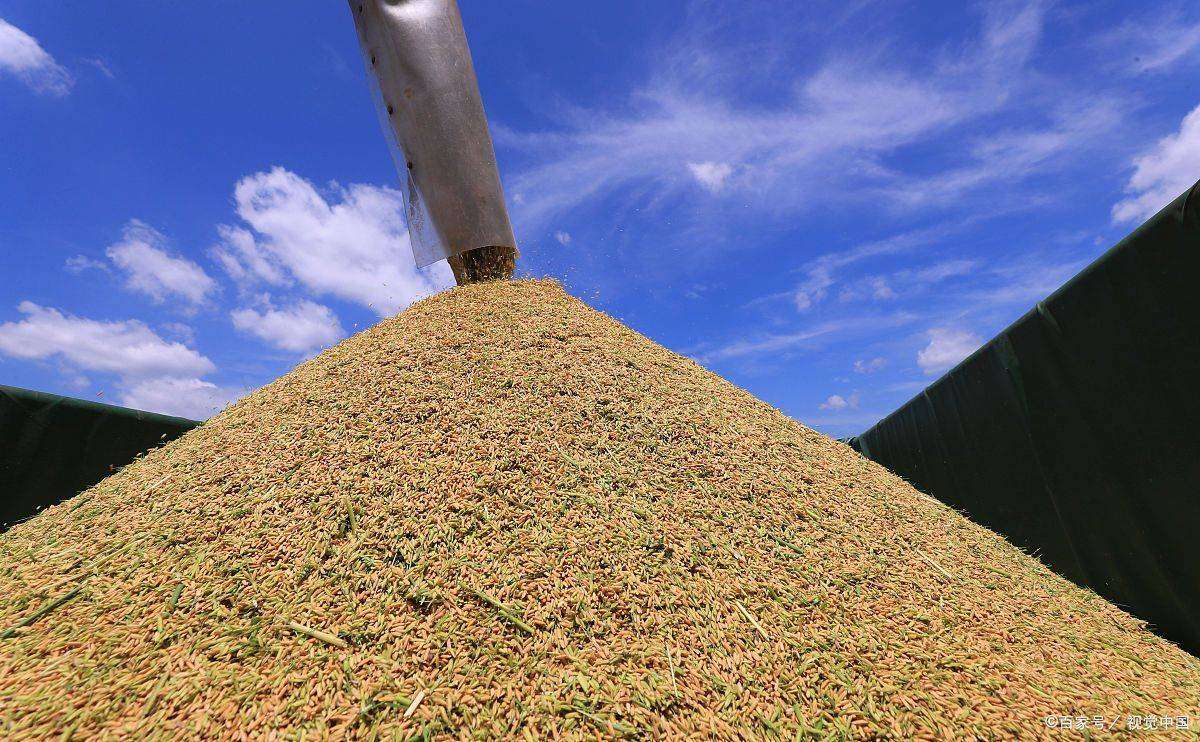

The global wheat market has seen significant fluctuations in recent years, with the Chicago Board of Trade (CBOT) wheat futures prices becoming a focal point for agricultural participants worldwide. The movements in CBOT wheat prices are not just numbers on a chart for American wheat producers and exporters; they wield influence over production decisions and market behaviors in other wheat-producing nations as well. To thoroughly analyze these price dynamics, it is crucial to grasp the interplay between the global supply chain and the competitive landscape of exports.

In recent weeks, pressures have driven CBOT wheat prices downward, landing at approximately 5.58 cents per bushel for the primary contracts. Several pivotal factors contributed to this decline, primarily the ample global supply and competitive pressures from exporters. Countries like Australia and Argentina have been offering lower prices, adding downward momentum to the market.

Recent procurement actions from large buyers illustrate this dynamic well. For instance, Japan recently purchased 113,000 tonnes of food-grade wheat, while Saudi Arabia announced an international tender for about 595,000 tonnes, with results expected next week. However, despite these movements, U.S. wheat export sales came in at merely 290,000 tonnes, which was near the lower end of market expectations, indicating tepid demand.

Looking forward, it appears that U.S. wheat prices may remain constrained in the short term due to international competition and a surplus supply scenario. Nonetheless, the uncertain export policies from Russia could potentially create upward price pressure. Traders and analysts alike will be closely observing the outcomes of the recent Saudi Arabian tender and subsequent procurement trends.

The challenges facing the global supply chain are manifold and complex, particularly in the context of wheat. The intricate demand and supply ecosystem involves several major producing and consuming nations. In recent years, the landscape has been significantly influenced by extreme weather events, rising geopolitical tensions, and labor shortages in agricultural fields, introducing a high degree of uncertainty into the wheat production and supply chain.

Extreme weather events have dramatically affected agricultural production globally. Climate change's impact is particularly pronounced in major wheat-producing countries such as the United States, Russia, Australia, and the European Union. Increased occurrences of extreme weather have exacerbated the volatility in wheat yield. For example, drought conditions in the U.S. have greatly affected major wheat-producing areas, contributing to a sharp decline in output. Meanwhile, inconsistent rainfall in certain regions of Russia has disrupted the planting timelines for wheat, further complicating the global supply situation. The ongoing trend of global warming is likely to exacerbate these issues, directly impacting the global wheat supply.

Logistics and transportation bottlenecks have further complicated the situation within the global wheat supply chain. The logistics system has faced unprecedented pressures, particularly during the COVID-19 pandemic when supply chains were severely disrupted, causing transportation costs to skyrocket. Due to uncertainties surrounding international shipping, the efficiency and reliability of wheat transportation have significantly deteriorated. This has meant that many wheat-producing nations, despite increased production, struggled to convert that output into export volumes, leading to inventory bottlenecks and unsold market stock. The fluctuations in CBOT wheat futures prices often mirror the impact of these supply chain difficulties on the market.

The rising costs of production present another pressing concern for wheat farmers worldwide. Over recent years, there has been a notable increase in agricultural production costs, predominantly due to soaring prices for fertilizers and energy. The skyrocketing cost of fertilizers has placed additional financial burdens on producers, effectively reducing the profitability of wheat farming. For numerous wheat-exporting countries, this sharp rise in costs not only diminishes the revenue from wheat production, but also affects their competitive edge in the export market, adding more strain to an already tight supply landscape.

Amid these challenges in the global wheat market, competition among exporters has intensified. The fluctuations in CBOT wheat prices cannot be attributed to a single factor; rather, they stem from various influences, including supply pressures and the complex competitive landscape among exporting nations. The competition among different wheat-producing countries has become increasingly fierce, marked by constant contestations over production volume, quality improvements, pricing advantages, and market share acquisition. This creates a dynamic and often tense environment for participants in the global wheat market.

Adjustments in export policies and strategies made by countries can be likened to strategic moves on this complicated chessboard of the wheat market. These adjustments profoundly shape the global market landscape. For example, certain nations may choose to implement favorable export subsidies to enhance their wheat's competitiveness in the international market. Through this approach, they can effectively lower the selling prices for their wheat in foreign markets, attracting more importers. This creates a significant challenge for other wheat-exporting nations, compelling them to reassess and modify their export strategies to remain competitive.

In addition, some countries might impose export quotas or tariffs to safeguard their domestic agricultural sectors or based on geopolitical considerations. These policy shifts directly impact the overall supply and distribution of wheat in the global market, triggering sharp fluctuations in CBOT wheat prices. If a major wheat-exporting country suddenly scales back its export quotas, the global supply might contract quickly, causing prices to surge due to heightened demand. Conversely, a concerted push towards wheat export liberalization and lowering tariffs by certain countries could result in increased market supply, placing downward pressure on prices.

As participants in the global wheat market wrestle with these factors, it becomes clear that the landscape is anything but static. Trends in climate change, trade policies, logistics, and production costs all interlink, influencing both present and future dynamics of the wheat market. The ongoing developments within this sector require constant vigilance and adaptation from various stakeholders, from farmers and exporters to policymakers and traders. Understanding these factors’ intricacies and interdependencies can prove essential for those looking to navigate the complexities of the global wheat market.

Leave a Reply